BANFF – The majority of Banff’s overall tax burden is this year shifting to the commercial hotel sector now that it is bouncing back from the economic fallout of the COVID-19 pandemic.

On Monday (April 8), council passed first reading of the tax rate bylaw on a 6-1 vote with a 5:1 mill rate split, which brings the Town of Banff in line with the provincial cap three years ahead of the 2027 compliance schedule for Banff.

The overall tax levy – which includes municipal, provincial education and Bow Valley Regional Housing taxes – is up 12.1 per cent from $31.8 million in 2023 to $35.7 million this year, with the average residential property seeing an overall tax increase of about 3.2 per cent based on the 5:1 split.

An average hotel, however, will see an increase of 42 per cent. An average downtown mixed-use property would see a decrease of 17.5 per cent, and an average industrial property would see a decrease of 11 per cent per cent.

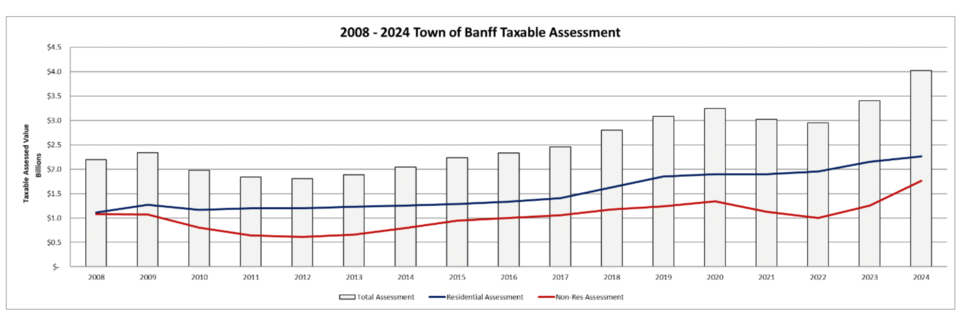

Officials say assessment values of non-residential properties, particularly hotels, continue to increase at a strong pace year over year, while assessment values of residential properties are rising at a more moderate pace. In February, the assessor said the average increase in assessed value for hotels was 68 per cent over the 2023 tax year, while all commercial classes together had an average assessment increase of 41 per cent.

“During the throes of the pandemic, when the business community, the hotels in particular, had a really, really hard time, a lot of the tax burden went on to the residential properties to help make up for it,” said Coun. Grant Canning.

“There was a lot of pressure that we had to put on residential properties to cover for the loss in revenue, so now that the pendulum has swung back, I think it’s fair that the commercial properties pay a little bit more,” he added.

“I think a 5:1 at this point is reasonable because I do think we’re at a point where the business community is recovering and I do think it will make up a little bit for the support the residential properties provided during the height of the pandemic.”

Administration had recommended a mill rate split of 4.3345:1, which would equalize the annual percentage increase in the municipal portion of the tax levy between residential and non-residential properties, based on guidance in Banff’s financial plan. This split is calculated based on the portion of the levy that is under the control of the municipality, including growth.

In this case, the average residential property would have seen an overall increase – municipal, school tax and housing levies – of approximately 9.50 per cent, but the average hotel would see an increase of about 39 per cent. An average downtown mixed-use property would see a decrease of 19.55 per cent, and an average industrial property would see a decrease of 13.34 per cent.

Mayor Corrie DiManno, who was the lone vote of opposition to the 5:1 split at first reading, leaned more towards the 4.3345:1 scenario.

She said she supported the philosophy to equalize the tax burden between residential and commercial properties, while also leaving space in the provincial mill rate regulatory ceiling before the 2027 deadline in case of any changes in the economic landscape in the coming years.

“If we simply move down to the 5:1 regulatory mill rate, we won’t have any room in the future to help us equalize if we experience any type of extenuating circumstances in the community again,” said DiManno.

Coun. Hugh Pettigrew, who put forward the motion for the 5:1 split, said a 9.5 per cent residential tax increase based on administration’s proposed 4.3345:1 split is “excessive.”

“The residents don’t have an ability, in my opinion, to up-charge at every level to recover some of the expenses that are incurred on them,” he said.

“Businesses, on the other hand, may have the ability to defer that, either to passing it on to the customers, whoever they may be, by rate changes.”

Coun. Ted Christensen was concerned higher residential taxes would mean property owners would pass those higher costs on to renters.

“I see the rental rates are already at a premium and we have our recognized housing crisis which has been for a long time,” he said.

“I don’t see that shifting the tax rate burden further to the residents will help us at all in that.”

The total overall taxable assessment for the Town of Banff has increased by 18.3 per cent from $3.40 billion to $4.02 billion. The total residential taxable assessment increased by 5.2 per cent from $2.15 billion to $2.26 billion, while non-residential assessments skyrocketed by 40.8 per cent from $1.25 billion to $1.76 billion.

Based on the 2024 operating budget approved by council on Jan. 17, 2024, the total municipal tax collection is $24.9 million, which represents about 70 per cent of the overall tax levy.

The provincial school tax requisition, which represents almost 30 per cent of the overall level, increased 17.55 per cent to $1.5 million. The residential requisition increased by 8.86 per cent and non-residential by 28.51 per cent.

The Bow Valley Regional Housing levy is just a fraction of the overall levy, going down 1.2 per cent from last year to $494,511 in 2024.

The deadline for assessment appeals is April 22; however, there are currently no outstanding appeals.

Council will consider second and third reading of the tax rate bylaw on April 22.

The following are some sample implications with a 5:1 commercial: residential split for property classes provided by the Town of Banff

Residential:

Real sample (Beaver Street condo): a typical home assessed at $556,500 for the 2024 tax year – based on the average five per cent assessment increase over the previous year – would see a total tax of $2,651, which is a 3.2 per cent over 2023 taxes, or $83 more in 2024 or $7 more per month for those on a monthly payment plan.

Residential properties that experience an average change in assessed value of five per cent will see a 3.2 per cent tax increase. Residential properties with an assessment change of more than the five per cent average will see taxes increase more than 3.2 per cent. Residential properties that see an assessed value increase below the five per cent average or if they see a decrease in assessed value, will see taxes increase less than 3.2 per cent or could see a drop in taxes.

Non-residential – hotel:

Real sample No. 1: A hotel on Banff Ave assessed at $29,266,570 for the 2024 tax year, which experienced an 88 per cent increase in assessed value over the 2023 tax year, will see property taxes of $426,786 in 2024, an increase of 60.1 per cent or $160,259 more this year.

Real sample No. 2: A hotel on Tunnel Mountain Road assessed at $38,493,790 for this tax year, that experienced a 52.8 per cent increase in assessed value over last year, will see total taxes of $561,344, representing a 30 per cent increase, or $129,257 more this year than last year in taxes.

Non-residential – mixed-use (eg retail/office):

Real sample: A downtown Banff Avenue property with mixed-use with a market value assessment of $8,814,520 for the 2024 tax year, that saw an assessment value increase of 3.8 per cent – average for this class was 5 per cent – will see a total tax in 2024 of $128,540, which is a 12 per cent drop in taxes, or a total of $17,163 less in taxes in 2024 over 2023.

Non-residential – industrial:

Real sample: a property on Hawk Avenue with an assessed value of $528,960 for the 2024 tax year, which saw its assessed value increase by 4 per cent, will see total taxes of $7,714 this year, representing a $1,000 decrease in annual taxes or a 11.5 per cent drop when compared to last year.