CANMORE – Several Town of Canmore policies and bylaws could soon be amended to begin the process of phasing out tourist home designation in the mountain community.

In an update to Canmore’s committee of the whole on Tuesday (May 21), Town staff outlined the necessary changes needed to phase out the tourist home designation such as the land use bylaw that restricts where tourist homes are permitted in the municipality.

“It’s imperative we know what other documents would be impacted, what other documents refer to tourist homes, what other documents allow it,” said Katherine Van Keimpema, the Town’s financial strategy manager.

“There’s [area structure plans] and all kinds of things that would have to be looked at. That’s part of a lot of work and it requires looking at all the statutory documents and it takes time and resources.”

In addition to the land use bylaw, the division of class 1 property bylaw, business registry licencing bylaw and property tax policy would need updates.

The land use bylaw and statutory planning documents would trigger a public hearing, but others such as the division of class 1 property bylaw and property tax bylaw wouldn’t need a hearing.

“All actions will proceed at the same time, although some will be completed before others, with changes to the LUB and any other statutory and non-statutory planning documents taking the most time due to the volume of work,” stated a staff report.

The division of class 1 property bylaw could see the tourist homes personal use subclass eliminated later this year, which would have all tourist homes taxed the same at the non-residential rate.

In 2022, council approved tourist homes being taxed at the non-residential mill rate, which is higher than residential properties. Tourist homes declared for personal use are taxed at the residential rate.

“Up until 2022, there was a special rate for tourist homes that was between residential and non-residential,” Van Keimpema said. “Starting in 2022, council has been taxing tourist homes at the non-residential rate and the tourist home personal use has been at the residential rate.”

According to the report, $302,000 in municipal taxes – at an average of $3,470 per declared personal use tourist home in 2023 – would’ve been shifted from residential tax burden to tourist homes had the 87 personal use tourist homes been taxed at the non-residential mill rate.

Van Keimpema said tax alignment implementation is expected to be back for council decision in the fall to prepare for the 2025 budget cycle. She noted the changes can be moved ahead of any potential changes to the land use bylaw.

All tourist homes, however, would be grandfathered in, but if they were to convert to a residential use there would be no going back to the tourist home use.

“When looking at conversation, we can’t force someone to convert to residential,” she said. “This would be at the property owner’s request. Once it’s converted to residential, they can’t revert back to the tourist home.”

Though the Town of Banff put a moratorium on bed and breakfasts last year while new regulations are developed, the report noted since bed and breakfasts are done through licencing and tourist homes in Canmore are through the land use bylaw the Town’s not able to do the same.

The business registry licencing bylaw could be amended to have all short-term rentals show a valid business licence number, with homes not having it displayed facing possible fines

“Starting in 2025, increased enforcement against illegal tourist homes will be required and the needed resources will be determined during implementation of the key actions. Funding for the position(s) will be included in the proposed budgets this fall,” stated the staff report.

Van Keimpema highlighted that any enforcement would need to be proactive rather than reactive. A property could also be required to have a local contact or property management, but a definition for how local that would have to be in the bylaw.

“In order to be effective, we need to have proactive enforcement, which means going in an auditing, looking through listings, seeing if the licencing number is posted on the advertisement, are people complying and that comes back to needing resources to do that,” she said.

Phasing out tourist homes is one of the three main initiatives for council’s Housing Action Plan approved last year.

Other aspects of the plan are to create a tax structure to encourage purpose-built rentals and a method to incentivize full-time and long-term occupancy in the community.

The recommendations came out of the Livability Task Force last January and implementation of recommendations is aimed for February 2025, with launching of programs shortly after.

The action plan also has Town staff directed to look at options for a comprehensive planning process for infill housing and possibly eliminating the building of single-family homes.

Town council approved earlier in May an extra $550,000 to be used from municipal reserves to move forward with the action plan. The money will be used to cover consulting services, add temporary finance staff and aid external legal costs for developing potential programs.

The first phase had been funded by $200,000.

The Housing Action Plan was approved in June, 2023, as part of Canmore’s application for the federal government’s Housing Accelerator Fund. Canmore was denied the application, with 179 of the 544 nationwide applications being approved.

The $4 billion fund is administered by Canada Mortgage and Housing Corporation and an extra $400 million was added as part of the 2024 federal budget.

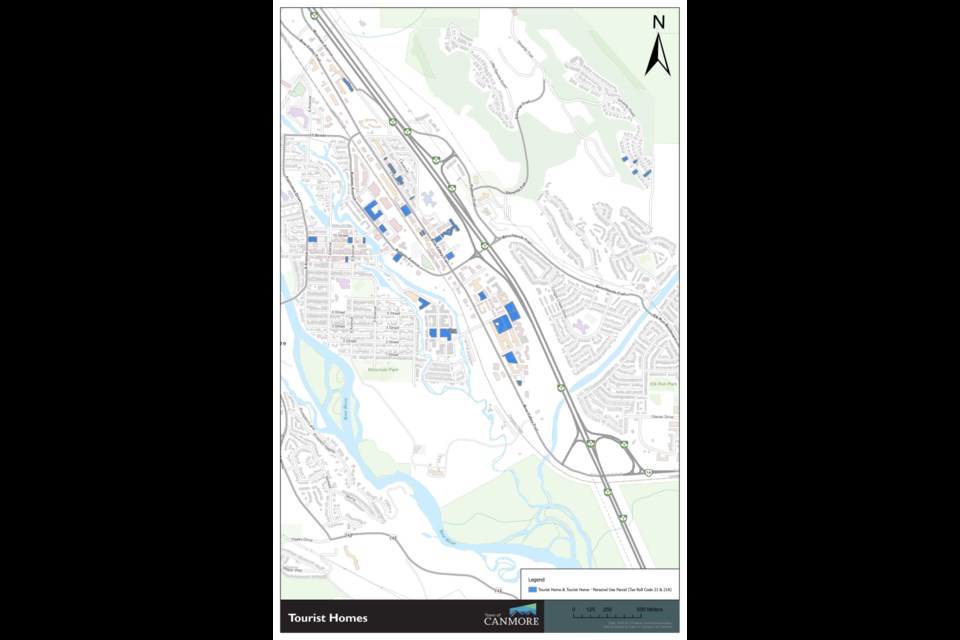

The amount of tourist homes in the community is relatively small – making up roughly five per cent or 716, including 76 declared for personal use in 2024, of the residential units in the community. However, it’s been a lightning rod among residents. The contention has only increased as housing costs soar and the availability has dwindled.

From 2013-22, tourist homes expanded from 515 to 685, while short-term accommodation went from 2,668 in 2014 to 3,334 in 2022. The same timeframe had multi-family condos grow from 3,949 to 5,418.

Statistics from Tourism Canmore-Kananaskis outlined visitor spending contributed $763 million in 2022, but when excluding accommodation it was $322.75 million and the total spending for 685 tourist homes was $26.5 million.

The Canmore Retail Gap Analysis and Light Industrial and Commercial Land Review study had visitor retail spending in 2022 at $256 million, while seasonal resident households were $25 million.

The staff report highlighted two development permits issued will add 33 more tourist home units and another one in progress is for four units.

Any changes to possibly phase out the tourist home designation would exclude such properties in Three Sisters Mountain Village Properties Limited Smith Creek and Three Sisters Village area structure plans.

The two high level plans were denied by council in 2021, but the Land and Property Rights Tribunal (LPRT) ordered the Town to adopt them in 2022 as they were submitted. The Court of Appeal upheld the LPRT’s decisions in 2023. An estimated 900-1,300 tourist homes will be developed during the buildout.

Other large-scale development sites in Silvertip and Spring Creek also have tourist homes built or soon-to-be developed.

“We can’t get it done soon enough, but we’re moving as fast as we can at the same time,” said Coun. Wade Graham, emphasizing the complex nature of the work.